U.S. House Rents Hold Steady as Apartment Rents Decline, Dwellsy IQ 2026 Rental Housing Index Shows

New report finds rental market stabilizing as new supply moderates, affordability limits rent growth, and local markets diverge from national trends

LOS ALTOS, CA, UNITED STATES, February 18, 2026 /EINPresswire.com/ -- Dwellsy IQ published its 2026 Rental Housing Index, a data-driven analysis of rental price movements across the U.S. produced in partnership with Briggs Advisors and released under Dwellsy IQ, Dwellsy’s enterprise rental data brand focused on providing high-quality rental market intelligence.

The report analyzes observed asking rent data through the end of calendar year 2025 using Dwellsy IQ’s first-party dataset of more than 17 million unit listings on Dwellsy, sourced directly from over 25,000 property managers nationwide. The analysis examines pricing patterns for three-bedroom rental houses and one-bedroom apartments, alongside market-level results across major U.S. metropolitan areas that highlight diverging regional rent trends.

“When you look at real, observed rent data rather than estimates from scraping or surveys, the story becomes clearer,” said Jonas Bordo, CEO of Dwellsy. “The volatility of the past few years has given way to a more balanced market, but the data also show that national averages can hide important differences between individual markets.”

Nationally, three-bedroom rental houses averaged $1,892 at the end of 2025, reflecting a modest 0.3% year-over-year increase. One-bedroom apartments averaged $1,338, marking a 0.7% year-over-year decline and the second consecutive year of falling apartment rents. Because these unit types represent the most common forms of rental housing, they serve as reliable indicators of broader rental market direction.

Key findings from the Dwellsy Rental Housing Index Report:

Houses

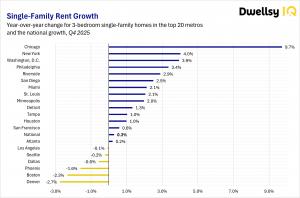

National house rents increased 0.3%, or $6, during 2025, ending the year at $1,892 per month. Demand for rental houses remained supported by high home prices and elevated mortgage rates that continue to keep many households in the rental market. Among major metropolitan areas, Chicago recorded the strongest rent growth, while markets such as New York, Washington, D.C., and Philadelphia also posted moderate increases. In contrast, Denver, Boston, and Phoenix recorded negative rent growth during the year.

Apartments

Apartment rents declined by 0.7%, or $9, in 2025, following a larger decline in 2024. At $1,338 per month, national apartment rents are now below levels observed at the beginning of 2020 and remain well below the peak reached in mid-2022. While some markets experienced seasonal gains, overall pricing remained under pressure due to recent supply deliveries and affordability constraints that limited landlords’ ability to push rents higher. Atlanta, Minneapolis, Chicago, Detroit, and New York were among the markets posting the strongest apartment rent growth in 2025, while Denver experienced the sharpest decline.

Rental Market Outlook for 2026

Looking ahead, the report suggests the rental market is entering a transition period rather than a rapid recovery. Decreasing construction activity is beginning to have a positive effect in some markets by helping rebalance supply and demand. However, ongoing new deliveries and strained household budgets are likely to limit the pace of rent growth in the near term.

In the rental house market, demand remains supported by high mortgage rates that keep many potential buyers in the rental pool, though the market is also monitoring potential regulatory changes related to institutional ownership and their impact on future investment and inventory.

The analysis concludes that national averages will likely continue to obscure local realities, with market performance increasingly driven by metro-level economic conditions and supply pipelines.

Raissa Cunha dos Santos

Dwellsy

raissa@dwellsy.com

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.